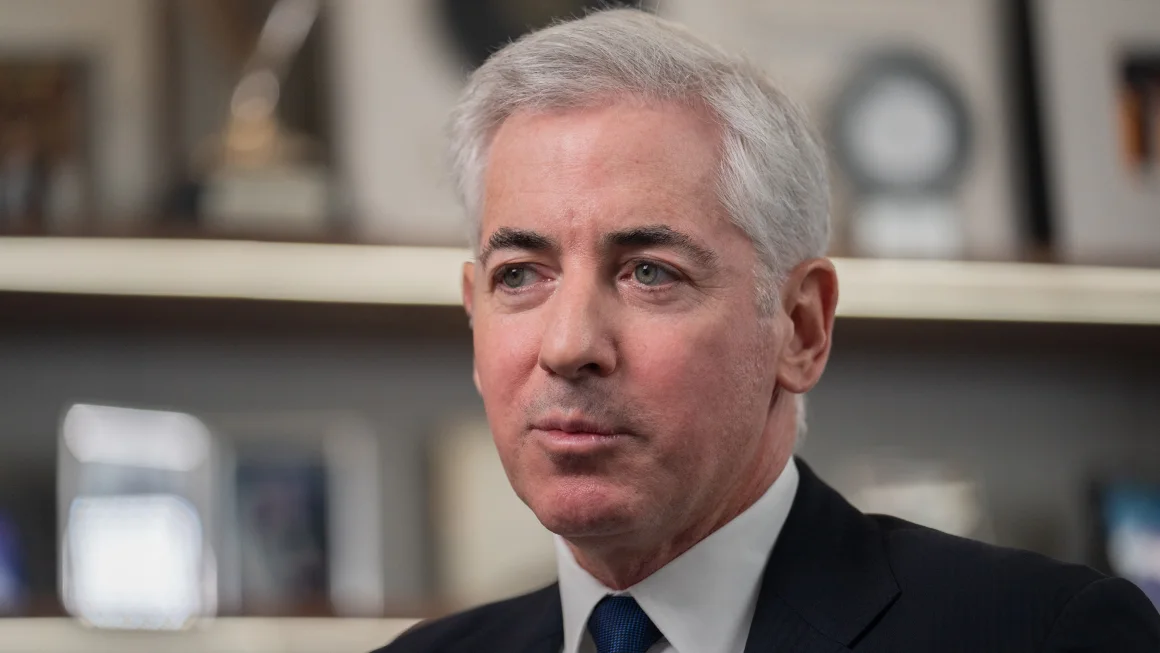

Bill Ackman to Relocate Pershing Square and Universal Music Group from Amsterdam Following Antisemitic Incidents

Ackman Cites Safety Concerns and Business Efficiency in Relocating Key Holdings from Amsterdam

·

The billionaire hedge fund manager cites safety concerns and improved business efficiency in a decision to consolidate listings in London.

In a decisive move, billionaire hedge fund manager Bill Ackman has announced plans to remove Pershing Square Holdings and Universal Music Group (UMG) from Amsterdam’s Euronext exchange, following recent antisemitic violence against Israeli soccer fans in the Dutch capital. Ackman, who has voiced concern about the city’s ability to safeguard its tourists and minority communities, stated that he would seek board approval from Pershing Square for the shift to the London Stock Exchange (LSE), where most of Pershing Square’s trading is already concentrated.

The decision comes after Thursday night’s Europa League game between Israel’s Maccabi Tel Aviv and the Netherlands’ Ajax, during which Israeli fans were reportedly assaulted, resulting in multiple injuries and over 60 arrests. Five injured fans were hospitalized but have since been released, while Amsterdam authorities reported that 10 suspects remain in custody.

In a post on X (formerly Twitter), Ackman explained that while this transition had been under consideration prior to these incidents, the attacks underscored his decision to accelerate the move. “Concentrating the listing on one exchange, the [London Stock Exchange], and leaving a jurisdiction that fails to protect its tourists and minority populations combine both good business and moral principles,” he said.

The shift promises to enhance liquidity for Pershing Square shareholders while also cutting operational costs, according to Ackman. He noted that this change would allow Pershing Square’s trading to be fully based on the LSE, creating a streamlined and efficient business model.

Ackman’s plans for Universal Music Group, where he serves as a board member, are similarly influenced by recent events, but he also cites a substantial undervaluation tied to UMG’s listing. As a U.S.-based company primarily listed in Europe, Universal Music Group is currently ineligible for key indices such as the S&P 500. Ackman believes this listing gap contributes to its significant trading discount, which could be alleviated by a primary listing on either the New York Stock Exchange or Nasdaq.

The proposed moves reflect Ackman’s belief in prioritizing both the security of company interests and moral values. As Ackman continues discussions with relevant boards, his decision underscores a commitment to operating in environments he perceives as both safer and better aligned with shareholder benefits.

Post Views: 99

- Paramount Ends Funding for Save the Music, Ushering in a New Independent Era

- Zayn Malik Returns to the Stage After a Decade: ‘I Forgot How Much I Love Doing This’

- Rihanna Stands by A$AP Rocky in Court Amid Shooting Trial

- Trump Dismisses Musk’s Criticism of $500B AI Project: “He Hates One of the People”